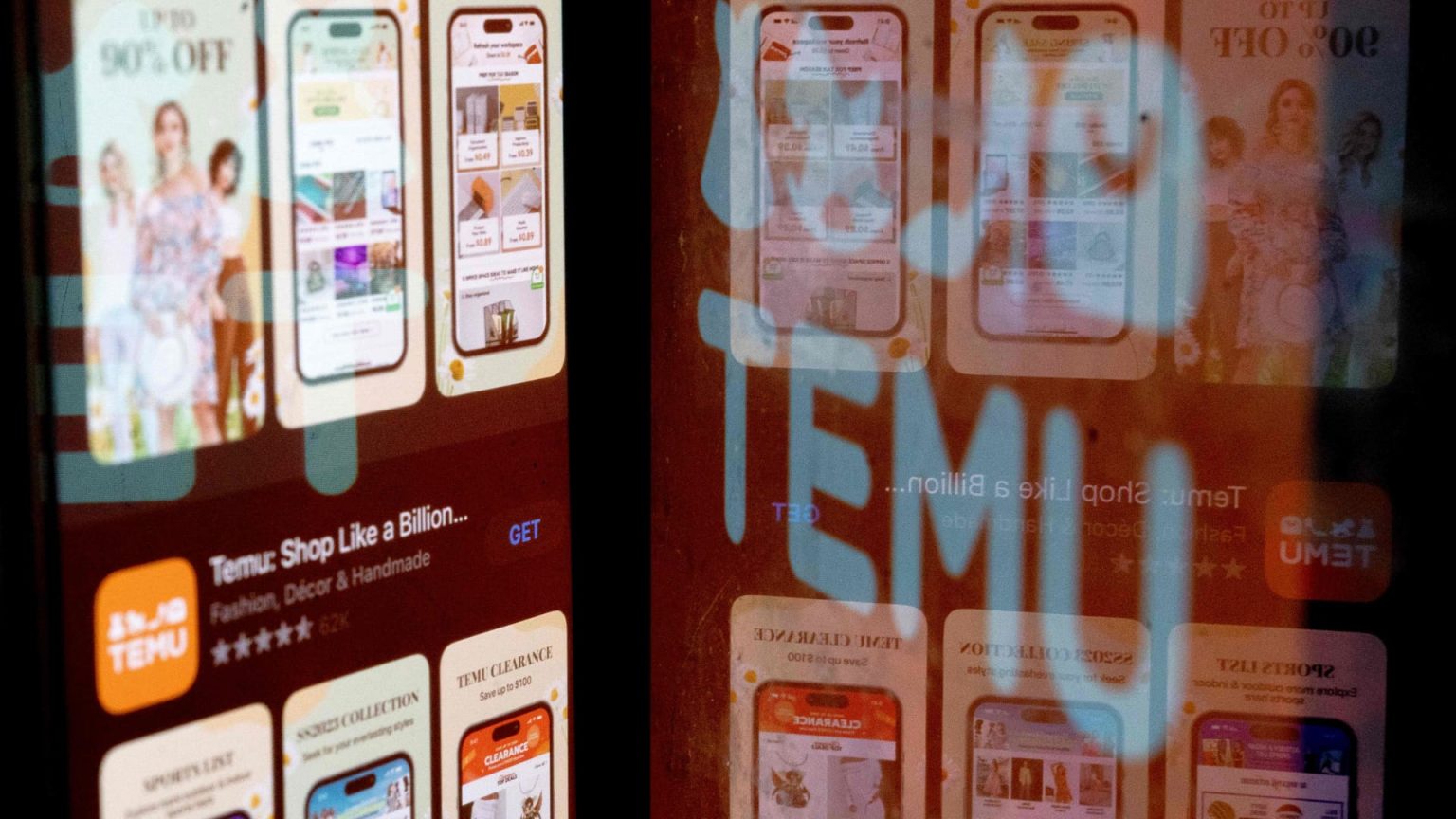

In a rapid decline, the Chinese online retailer Temu has recently seen a drop in its app ranking on the Apple App Store, slipping from the top spot just a few weeks after its launch. The sudden downturn, attributed primarily to heavy tariffs imposed by former President Donald Trump, has hit its advertising strategy hard. As a response, Temu now faces the prospect of raising prices on its products, reflecting broader implications for online shopping platforms and their reliance on imports from China.

| Article Subheadings |

|---|

| 1) Impact of Trade Policies on Temu |

| 2) Changes in Advertising Strategy |

| 3) Competitor Movements in the Market |

| 4) Consumer Reactions and Adjustments |

| 5) Future Outlook for Temu and Similar Brands |

Impact of Trade Policies on Temu

Temu, owned by PDD Holdings, has recently been adversely affected by sweeping tariffs imposed on imports from China. These tariffs, significantly raised to rates as high as 145%, have had a direct impact on the cost of goods shipped to the U.S., challenging Temu’s low-cost business model that previously attracted a deal-hungry American audience. The tariffs are expected to escalate further as the de minimis provision, which allows for certain low-value shipments to enter the country duty-free, is set to expire on May 2.

Due to these regulatory changes, Temu and competitors like Shein are preparing to raise their prices, a decision communicated to consumers through notices on their websites. Temu stated,

“Due to recent changes in global trade rules and tariffs, our operating expenses have gone up. To keep offering the products you love without compromising on quality, we will be making price adjustments starting April 25, 2025.”

The decision to increase prices could potentially alienate customers who have come to expect low prices, making it crucial for Temu to navigate these changes effectively in order to maintain its market presence.

Changes in Advertising Strategy

In addition to the challenges posed by tariffs, Temu has dramatically reduced its advertising spending in the U.S. after a prolonged campaign that saw it become one of the largest advertisers on platforms like Facebook and Google. According to data from marketing analytics firm SimilarWeb, Temu’s paid traffic has plummeted by approximately 77% since early April. This decline is stark, given that just weeks prior, their paid advertisements resulted in an impressive click-through rate, significantly outpacing non-paid traffic.

Marketing firm Tinuiti noted a drastic shift; Temu’s share of U.S. Google Shopping ad impressions fell from 20% to nearly zero within just a week. This sharp reduction indicates a crucial turning point for the brand, suggesting it may be reevaluating its approach to customer acquisition in light of rising operational costs. While Temu continues to run ads globally, particularly in Europe, its absence in the U.S. market could signify a strategic pivot towards maintaining profitability in other regions amidst increasing challenges at home.

Competitor Movements in the Market

As Temu’s app ranking on the Apple App Store has fallen to No. 69, rival platforms are quickly capitalizing on its downturn. Brands such as DHgate and Alibaba have seen significant increases in their app rankings, with reports indicating that videos promoting their affordable products have garnered viral attention, driving downloads upward. DHgate has climbed to become the No. 2 top free iPhone app in the U.S., while Taobao from Alibaba has reached No. 7.

In response to these shifts, Amazon has launched its own discount shopping platform known as Amazon Haul, aimed at providing competitively priced goods, typically sourced from China. This heightened competition not only signals the challenges faced by Temu but also highlights the growing power of the e-commerce sector as businesses adapt to ever-changing consumer needs. The looming presence of these competitors raises the stakes for Temu, which must innovate to remain relevant in a crowded marketplace.

Consumer Reactions and Adjustments

The general consumer reaction to Temu’s potential price increases and reduced marketing presence is likely one of caution. Many shoppers are accustomed to the budget-friendly offerings that Temu has promoted through aggressive advertising. The swift changes in pricing structure could dampen enthusiasm for the brand, endangering its ability to attract new customers. Existing users may also question the value proposition if the cost of goods aligns more closely with competitors who offer similar products.

Furthermore, other retailers that depend on imports from China are contemplating similar price increases, creating a ripple effect throughout the online shopping landscape. As noted by sellers on platforms like Amazon and TikTok Shop, the higher tariff costs are reshaping their pricing strategies and could lessen consumer spending. The shift in consumer perception towards rising prices may influence shopping habits and preferences, compelling retailers to consider value-added offerings beyond mere discounts to retain customer loyalty.

Future Outlook for Temu and Similar Brands

Looking ahead, the future for Temu amidst these transformative market dynamics appears uncertain. Analysts anticipate that while the company may eventually revive its advertising initiatives in the U.S., much will depend on the stabilization of trade policies and operational costs. Market observers expect various online retailers, Temu included, to explore diverse strategies, possibly expanding their target markets or adjusting their product offerings to counterbalance the impact of tariffs.

E-commerce analyst Juozas Kaziukenas notes, “It doesn’t mean Temu usage has dropped as significantly as the app did, but it means that new user acquisition is gone.” This statement underscores the potential for a rebound should market conditions improve. However, for now, Temu stands at a critical juncture, needing to adapt to an increasingly complex regulatory environment while also addressing consumer expectations in a highly competitive marketplace.

| No. | Key Points |

|---|---|

| 1 | Temu has seen a significant decline in app ranking and downloads following recent tariff increases. |

| 2 | The company is reducing its advertising spending in the U.S. after being a major advertiser. |

| 3 | Rival brands are taking advantage of Temu’s decline, with notable gains in app rankings. |

| 4 | Consumers may react negatively to potential price increases, shifting shopping habits. |

| 5 | Analysts suggest that Temu may explore new strategies to adapt to changing market conditions. |

Summary

The trajectory of Temu signifies the profound impact of global trade policies on small to medium e-commerce platforms. With the company grappling with drastic changes in both its advertising strategy and pricing models, the future remains precarious as it navigates competition and rising operational costs. As other retailers adapt to similar pressures, the evolving landscape of online shopping will likely continue to transform in ways that challenge conventional business models, highlighting the need for agility and innovation in the face of uncertainty.

Frequently Asked Questions

Question: What are the main reasons for Temu’s recent drop in app ranking?

The drop in Temu’s app ranking can be attributed to increased tariffs on Chinese imports, which have led to rising operational costs and a need to potentially raise prices. Additionally, the company has sharply reduced its advertising presence in the U.S., significantly impacting customer acquisition.

Question: How are competitors responding to Temu’s decline?

Competitors such as DHgate and Alibaba have capitalized on Temu’s decline, rising in app rankings and gaining consumer attention through viral marketing strategies. Amazon has also entered the market with a competing platform, emphasizing the intensity of the current retail landscape.

Question: What steps might Temu take in the future?

In the future, Temu may need to readjust its advertising strategy and explore new markets to maintain consumer engagement. Analysts suggest that while they may temporarily pull back from U.S. advertising, a revival could be on the horizon, contingent on stabilization in trade policies and operational costs.