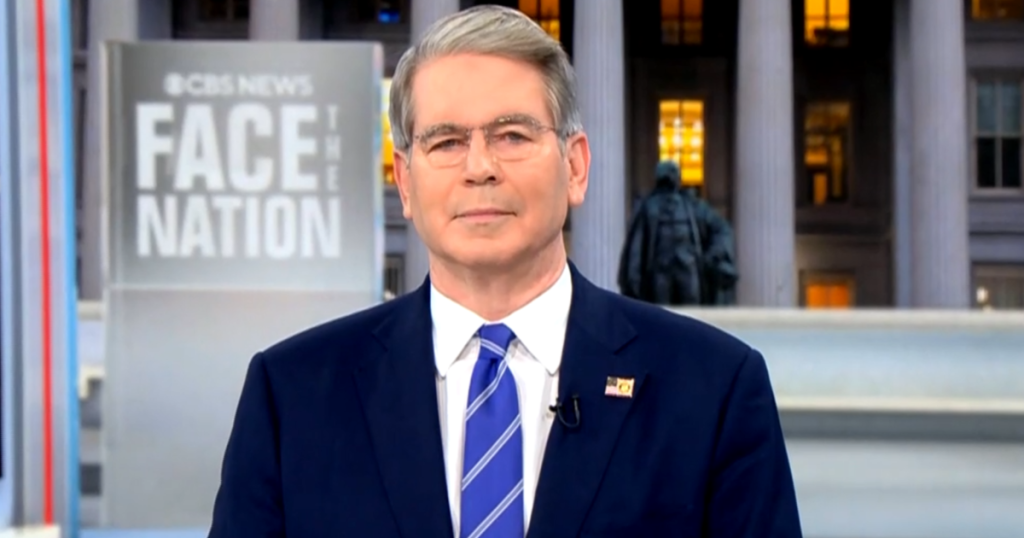

In a recent interview aired on a prominent news program, Treasury Secretary Scott Bessent discussed significant economic concerns raised by growing tensions between the United States and China. Emphasizing the need for a safer supply chain, he highlighted the U.S. intention to de-risk its reliance on China without completely decoupling the economic relationship. Additionally, the Secretary addressed inflation fears related to tariffs and outlined the necessary communication between U.S. and Chinese leadership to enhance market stability.

| Article Subheadings |

|---|

| 1) Risks of Economic Decoupling |

| 2) Consequences of Trade Negotiations |

| 3) Impact on American Consumers |

| 4) Future of U.S.-China Relations |

| 5) Implications of Upcoming Legislation |

Risks of Economic Decoupling

During the interview, Secretary Bessent addressed concerns about the potential decoupling of the U.S. economy from China. He pointed out that the global economic landscape has evolved since the onset of the COVID-19 pandemic, highlighting how China’s actions during the pandemic reflected an unreliability that necessitated a shift in strategy. According to Secretary Bessent, it is imperative for the U.S. to adopt a ‘de-risking’ maneuver rather than an outright decoupling from China, as complete separation could have severe repercussions, not just locally but globally.

The Secretary explained that the U.S. government is focusing on essential sectors—such as semiconductors and pharmaceuticals—where dependence on Chinese products has proven to be a critical vulnerability. This push for de-risking aims at ensuring that supply chains are secure and resilient, which should protect against future disruptions caused by foreign reliability issues.

Consequences of Trade Negotiations

A key concern during the discussion revolved around the stalled trade negotiations with China. Secretary Bessent spoke in-depth about the importance of the ongoing dialogues between U.S. leaders and Chinese authorities. He indicated that President Trump would soon engage in discussions with Chinese President Xi Jinping to address discrepancies arising from recently negotiated agreements. The immediate focus is on products vital to U.S. supply chains being withheld by China, which has raised concerns regarding adherence to agreements made during the negotiations.

The Secretary expressed confidence that dialogue between the two leaders would be instrumental in resolving issues stemming from these trade agreements. However, he did not shy away from the potential consequences if China is found to be intentionally failing to comply with previous commitments. This uncertainty about compliance creates a volatile economic environment, with significant ramifications for both countries and their respective economies.

Impact on American Consumers

As the conversation progressed, the topic turned toward how these economic tensions and tariff systems would affect American consumers. Secretary Bessent acknowledged concerns raised by some retailers about possible price increases resulting from new tariffs, particularly in the back-to-school shopping season. He confidently stated that while some prices might rise, others were projected to remain stable or even decrease, implying a complex situation at play.

Secretary Bessent argued that inflation rates were beginning to fall, refuting some pessimistic predictions. He stated that consumer earnings have shown significant monthly increases, emphasizing that the inflation numbers reflected a healthier consumer market. He made it clear that while tariff-based pressures exist, the overall economic outlook is increasingly positive for the American consumer.

Future of U.S.-China Relations

Moving to the broader dynamics at play in U.S.-China relations, Secretary Bessent emphasized the importance of understanding China’s strengths. Recently, remarks from notable business leaders suggested that some U.S. policymakers might be underestimating China’s economic resilience and strategic competency. In this context, Secretary Bessent took a cautious stance, acknowledging that both American and Chinese economies are subject to market realities that govern their respective operations.

A focal point in the dialogue was the role of leadership communication to foster better economic relations. Secretary Bessent assured that as communications between the two nations’ leaders resume, the complexities of the relationship would continue to be addressed, aiming to counterbalance the tug-of-war witnessed in recent months.

Implications of Upcoming Legislation

Ending the discussion on a legislative note, Secretary Bessent discussed upcoming debt ceiling negotiations in Congress. He assured the American public that the United States would not default on its obligations, highlighting a belief that lawmakers would navigate this challenge effectively. He expressed optimism regarding the ongoing bill in Congress and noted that bipartisan cooperation could produce results that align with the country’s long-term financial goals.

He detailed the measures being considered, emphasizing tax strategies aimed at alleviating burdens on working Americans. Secretary Bessent indicated that these legislative changes could potentially boost both short-term relief and long-term economic stability.

| No. | Key Points |

|---|---|

| 1 | Secretary Bessent emphasizes the need for de-risking the U.S. economy from China rather than full decoupling. |

| 2 | Ongoing trade negotiations between the U.S. and China are crucial for stabilizing economic relations. |

| 3 | Projected impacts of tariffs on American consumers may vary, with some prices expected to rise while others decrease. |

| 4 | U.S.-China economic relations depend heavily on effective communication between leadership from both nations. |

| 5 | Legislative actions regarding the debt ceiling aim to mitigate impacts on the American economy while fostering cooperation between parties. |

Summary

The interview with Treasury Secretary Scott Bessent sheds light on the current economic challenges posed by the U.S.-China relationship. As various tensions escalate, officials stress the need for careful navigation and communication to protect not only U.S. interests but also global economic stability. As legislation unfolds regarding economic measures and trade, the potential implications for both the domestic market and international relations remain critical for stakeholders across the board.

Frequently Asked Questions

Question: What does de-risking mean in the context of U.S.-China relations?

De-risking refers to the strategy of reducing dependency on China for critical supplies and trade while still maintaining an economic relationship, aiming to enhance supply chain security.

Question: How do tariffs impact American consumers?

Tariffs can result in higher prices for imported goods, affecting consumer costs, although some sectors might maintain lower prices based on market dynamics.

Question: What measures are being taken regarding the U.S. debt ceiling?

Legislative discussions are underway to address the debt ceiling, with assurances from officials that the U.S. will not default on financial obligations, aiming to foster bipartisan cooperation to achieve economic stability.