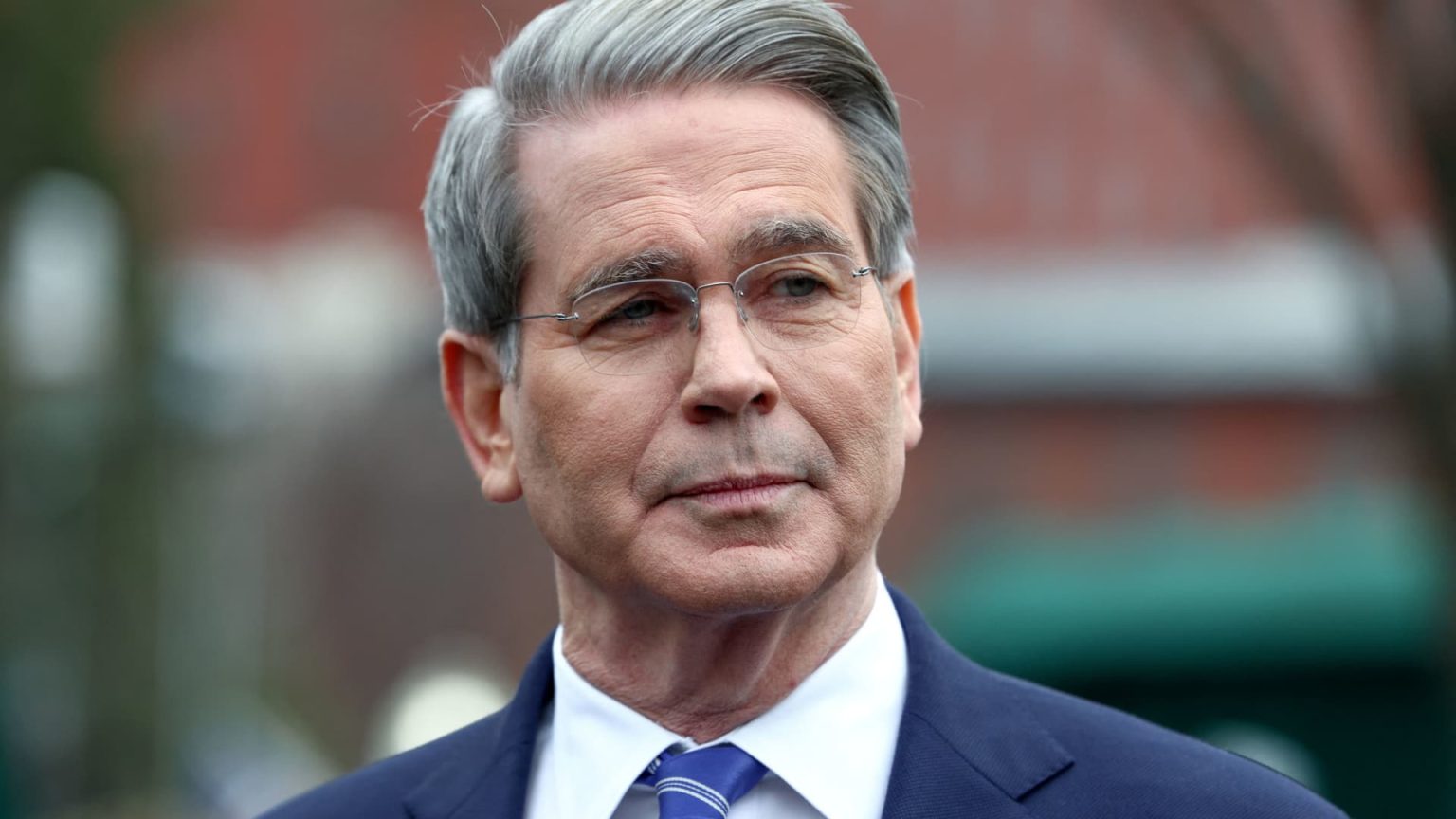

On March 13, 2025, U.S. Secretary of the Treasury Scott Bessent addressed concerns regarding economic uncertainty and the status of retirement plans during an interview on NBC News’ “Meet the Press.” Bessent dismissed fears about a potential recession, attributing recent stock market fluctuations to external factors, particularly President Donald Trump’s tariff announcements. He emphasized the long-term view that many Americans maintain towards their investments and reassured the public that the administration is focused on building a robust economic foundation.

| Article Subheadings |

|---|

| 1) Bessent on Retirement Concerns |

| 2) Market Reaction to Tariffs |

| 3) Long-term Economic Strategy |

| 4) Historical Context of Economic Adjustments |

| 5) Critique of Previous Economic Policies |

Bessent on Retirement Concerns

In his interview, Scott Bessent addressed the anxiety some Americans feel about their retirement plans in light of recent fluctuations in the stock market. He firmly stated that the narrative suggesting Americans nearing retirement are hesitant due to recent losses is inaccurate. “I think that’s a false narrative,” he asserted, highlighting that many individuals who have saved diligently do not overly focus on daily market changes. Instead, they adopt a long-term outlook that remains steadfast even during downturns.

This perspective draws attention to the reality that retirement savings can fluctuate but do not necessarily dictate an individual’s readiness to retire. Bessent emphasized that the stock market is considered a favorable investment primarily for its long-term performance rather than its day-to-day price movements. He mentioned, “If you look day to day, week to week, it’s very risky. Over the long term, it’s a good investment.” By framing the discussion this way, Bessent seeks to reassure those nearing retirement that they should remain confident in their financial planning despite short-term volatility.

Market Reaction to Tariffs

The announcement of tariffs by President Donald Trump, reaching as high as 54% on key trading partners, sparked immediate reactions in the stock market. Following the tariffs’ unveiling, major indices such as the Nasdaq, Dow Jones Industrial Average, and S&P 500 experienced significant declines, reminiscent of the initial disruptions seen during the COVID-19 pandemic. In response to the market’s downturn,

Bessent reiterated that he was not particularly concerned about the immediate effects, suggesting that the market often misjudges Trump’s fiscal strategies. “The market consistently underestimates Donald Trump,” he remarked, underscoring a belief in the administration’s broader economic vision.

As the stock market struggled, President Trump maintained a positive outlook, encouraging investors and the public to “hang tough” and remain patient. He claimed that the tariffs would eventually lead to a substantial economic turnaround, emphasizing already significant investments into the U.S. economy. This optimism stands in stark contrast to the primary market indicators, leading many to question the administration’s approach in the face of obvious market anxieties.

Long-term Economic Strategy

During his interview, Scott Bessent articulated the administration’s commitment to implementing tariffs as a cornerstone of its economic strategy aimed at bolstering long-term growth. While acknowledging the turbulence in the markets, he stressed the importance of maintaining the course toward sound economic fundamentals. Bessent referred to the previous administration’s policies as leading to “financial calamity,” positioning the current tariff measures as necessary corrections that align with Trump’s broader economic goals.

Bessent’s dialogue indicated an effort to reframe what might be seen as temporary setbacks into strategic adjustments that aim to rectify imbalances in trade relationships that have developed over years. He argued that prior trade systems had allowed other countries to take significant advantages over the U.S., manifesting in trade surpluses and budget deficits. By contrasting these measures with past trajectories, he suggests a narrative of long-term correction rather than short-term disruption.

Historical Context of Economic Adjustments

Bessent’s comments drew parallels with historical precedents in U.S. economic policy, specifically referencing President Ronald Reagan’s administration. He described the present situation as an “adjustment process” similar to the choppy economic landscape experienced during Reagan’s efforts to combat severe inflation rates. Bessent pointed out that although such adjustments may present short-term challenges, they are essential for paving the way toward more stable economic conditions in the future.

This contextualization serves to remind both lawmakers and the American public that economic cycles often entail periods of instability. By citing the past, he called for patience and perseverance as the administration faces headwinds akin to those managed by Reagan. The implication is that while the current measures might be difficult, they could ultimately lead to a stronger economic framework.

Critique of Previous Economic Policies

In his interview, Bessent did not shy away from critiquing the economic policies implemented by previous administrations. He labeled the existing trade practices as “unsustainable,” indicating that the issues confronting the modern economy are the results of years of missed opportunities to rectify these trade imbalances. According to Bessent, the combination of trade deficits and supportive fiscal policies from prior leaders created systemic vulnerabilities that necessitated the current administration’s aggressive tariff stance.

He articulated that “our trading partners have taken advantage of us,” suggesting a need for more equitable trade arrangements. By drawing attention to these historical imbalances, Bessent is reinforcing the administration’s narrative of change and renewal, presenting the current policy framework as critical to restoring the country’s competitive standing in global trade. This critique sets the stage for ongoing negotiations and legislative discussions that are likely to continue shaping U.S. economic policy.

| No. | Key Points |

|---|---|

| 1 | Secretary Bessent reassured Americans, particularly retirees, addressing fears related to market fluctuations. |

| 2 | The stock market’s recent downturn followed President Trump’s high tariff announcements. |

| 3 | Bessent emphasized the administration’s focus on long-term economic fundamentals despite market volatility. |

| 4 | Historic economic adjustments were likened to Reagan’s efforts to manage inflation, highlighting the importance of patience. |

| 5 | Bessent criticized previous trade policies as unsustainable and highlighted the need for strategic correction. |

Summary

In conclusion, Secretary of the Treasury Scott Bessent articulated a strong confidence in President Donald Trump’s economic policies during a time of market uncertainty. By dismissing the fears surrounding retirement savings and emphasizing the importance of long-term investment strategies, Bessent aimed to portray a sense of stability and direction amidst shifting economic landscapes. His insights into historical economic adjustments along with critiques of past policies lend credence to his narrative of necessary transformation aimed at forging a stronger economic future for the United States.

Frequently Asked Questions

Question: What were Secretary Bessent’s views on concerns about retirement plans?

Secretary Bessent dismissed concerns regarding retirement plans, characterizing the idea that retirees are hesitant to leave the workforce as a “false narrative.” He emphasized that many Americans maintain long-term investment strategies and do not solely focus on daily market fluctuations.

Question: How did the stock market react to President Trump’s tariff announcements?

Following President Trump’s announcement of tariffs of up to 54% on major trading partners, the stock market experienced a sharp decline, with significant losses in the Nasdaq, Dow Jones Industrial Average, and S&P 500, mirroring conditions not seen since the COVID-19 pandemic.

Question: What historical context did Bessent use to support current economic policies?

Bessent referenced past economic adjustments, particularly under President Reagan, to illustrate the need for patience amidst current economic turbulence. He suggested that just as Reagan faced challenges in managing inflation, the current administration’s tariff measures are aimed at correcting longer-term economic imbalances.