In a bold move, the Trump administration has announced new tariffs aimed at reshaping the U.S. economic landscape. This strategy, which some analysts view as crucial for addressing the nation’s staggering debt, is not simply about trade wars or price hikes; it is part of a comprehensive plan to regulate the economy. With the U.S. facing a significant debt wall, the government hopes to reduce borrowing costs while stimulating domestic industry—all while navigating complex global relationships and constraints imposed by inflation.

| Article Subheadings |

|---|

| 1) Understanding the Debt Crisis Facing the U.S. Government |

| 2) The Mechanics of Tariffs and Their Economic Implications |

| 3) Spending Cuts and Their Role in Debt Management |

| 4) Tariffs as a Strategy for Domestic Growth |

| 5) Geopolitical Ramifications of New Tariff Policies |

Understanding the Debt Crisis Facing the U.S. Government

The U.S. government is grappling with an enormous debt that necessitates urgent attention. By 2025, the nation needs to refinance $9.2 trillion in maturing debt, with about $6.5 trillion due by June of that year. This staggering figure represents more than just a fiscal challenge; it is akin to facing a financial wall that could significantly impact federal operations and services.

Treasury Secretary Scott Bessent highlighted how each one-basis-point reduction in interest rates could save the government approximately $1 billion annually. As the tariffs were introduced on April 2, 2025, there was a notable drop in 10-year Treasury yields from 4.2% to 3.9%, indicating a financial reprieve. This decrease—amounting to 30 basis points—could potentially result in a staggering $30 billion savings if sustained.

Thus, the administration’s aggressive stance on tariffs is not merely a tactical maneuver; it is a response to a pressing financial imperative. Keeping interest rates low is fundamental for managing these debts effectively and can stabilize the financial climate as the administration reassures investors amid uncertainties.

The Mechanics of Tariffs and Their Economic Implications

The introduction of sweeping tariffs aims to create economic conditions that yield lower borrowing costs. The strategy hinges on inducing investor anxiety via uncertainty, compelling them to seek safer investment avenues such as long-term U.S. Treasury securities. This could further drive down yields and, consequently, borrowing costs for the government.

While it may appear paradoxical to employ tariffs to facilitate lower yields, this methodology, dubbed a “detox” for a previously overheated financial system, seeks to stabilize markets by compelling a flight to safety. As risk factors proliferate, capital tends to flow into safe harbors like government bonds, pushing yields lower. However, this tactic brings about its own set of complications, particularly in how it interacts with the nation’s current fiscal landscape.

In the face of persistent inflation, the Federal Reserve is cautious about any rapid cuts. Consequently, the administration hopes these tariffs can curtail yields independently of the Fed’s policy actions, maintaining an environment conducive to managing the burgeoning debt without further exacerbating inflation pressures.

Spending Cuts and Their Role in Debt Management

Accompanying the tariff implementation, the administration is targeting substantial spending cuts to bring the deficit under control. Collaborating with the Department of Government Efficiency (DOGE) and led by technology entrepreneur Elon Musk, the administration aims to reduce daily expenditures by approximately $4 billion. This ambitious goal could amount to as much as $1 trillion in deficit reduction by the end of 2025 if implemented successfully.

Such sweeping cuts are critical as the government balances its books and seeks to remain viable amidst economic challenges. Although lower borrowing costs offset some fiscal pressures, cuts in spending are equally vital for rectifying the deficit. Congress’s subsequent approval will determine the actualization of these cuts, highlighting an essential component of fiscal discipline amidst a tumultuous economic cycle.

Despite the beneficial effects these moves could have, challenges persist; larger political tensions surrounding government spending are likely to arise. Balancing cutbacks with public demand for social programs, healthcare, and essential services could prove contentious, necessitating careful negotiation and political strategy.

Tariffs as a Strategy for Domestic Growth

Beyond managing debt and minimizing spending, the administration views tariffs as a means to revive domestic industries and create growth opportunities. By implementing these tariffs, the government intends to raise import prices, thereby affording American manufacturers some breathing room to regain market share that has been lost to international competition.

The overall objective is not merely to penalize foreign trade partners but to fortify the U.S. industrial base. The administration anticipates job growth in strategic sectors such as steel, automobiles, and textiles, many of which are concentrated in battleground states—a political strategy aimed at garnering support in crucial electoral regions.

While recognizing the possible inflationary effects of raised prices on consumers, the administration anticipates that the long-term benefits of job creation and increased factory activity will yield a more robust economy ahead of the 2026 midterm elections. Coupled with revenue generated from tariffs—estimated at around $700 billion in the first year—this could bolster the administration’s ability to implement tax cuts and maintain funding for important social programs.

Geopolitical Ramifications of New Tariff Policies

The implications of the new tariff policies extend well beyond U.S. borders, influencing global economic relationships and arrangements. The strategy represents a recalibration of American diplomatic ties and alliances. Recently, the U.S. has begun to distance itself from NATO and is engaging in new dialogues with nations such as those in the Gulf and Russia, signaling a significant shift in foreign policy.

As the post-Cold War economic framework increasingly appears misaligned with U.S. interests—particularly through trade deficits and reliance on foreign entities—the introduction of tariffs serves as a tool of economic leverage. Countries that align with U.S. priorities may benefit from tariff relief, while those that do not may face steeper costs.

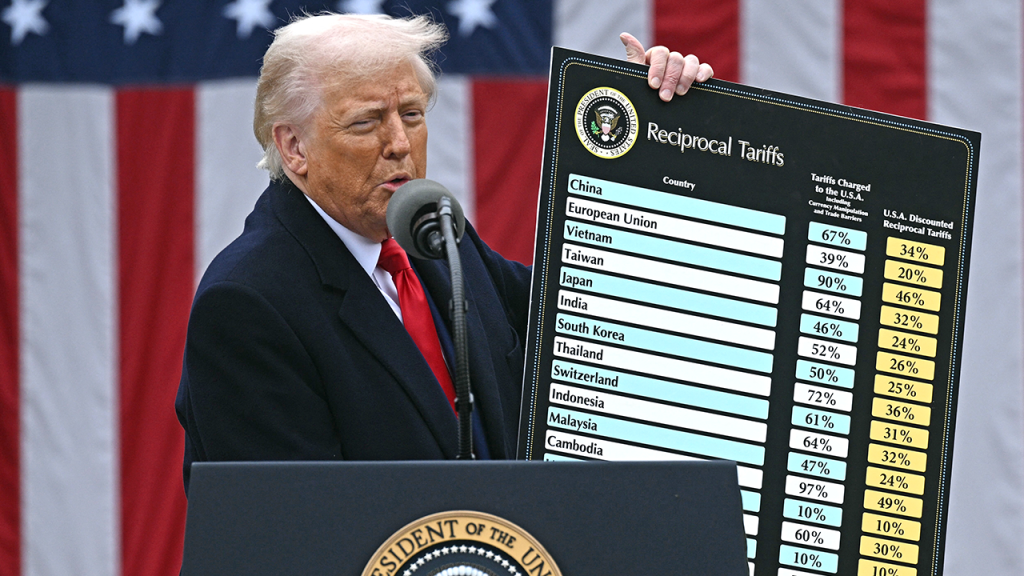

Particularly with China, economists believe the tariffs aim to address imbalances created by Beijing’s currency policies, with the potential to force revaluation of the yuan amid ongoing trade tensions. Other nations, including European allies, India, Canada, and Mexico, may also face negotiated adjustments within the context of this shifting economic landscape.

These moves signal not just economic policy but a re-envisioning of how the U.S. interacts with the global economic order, seeking to fortify its own position while addressing long-standing strategic concerns.

| No. | Key Points |

|---|---|

| 1 | The U.S. faces a $9.2 trillion debt wall with urgent refinancing needs by 2025. |

| 2 | Tariffs aim to create uncertainty that drives investment into safer U.S. Treasury assets. |

| 3 | Spending cuts are proposed alongside tariffs to target a substantial deficit reduction. |

| 4 | Tariffs are seen as a means to bolster domestic industries and create job growth. |

| 5 | The new tariff policy could reshape global alliances and leverage U.S. interests on the international stage. |

Summary

The Trump administration’s rollout of new tariffs signifies a multidimensional economic and political strategy designed to address the nation’s pressing debt while stimulating domestic growth. By lowering borrowing costs and instituting spending cuts, it seeks to fortify the economy against foreseeable challenges while recalibrating geopolitical relationships. Whether the tariff strategy will ultimately prove effective remains to be seen, but its ambition marks a significant chapter in the ongoing evolution of U.S. fiscal and industrial policy.

Frequently Asked Questions

Question: What are the primary goals of the new tariffs announced by the administration?

The primary goals include reducing U.S. debt burdens, stimulating domestic manufacturing, and lowering borrowing costs by driving investments toward long-term Treasury securities.

Question: How much debt does the U.S. government need to refinance in 2025?

The U.S. government must refinance approximately $9.2 trillion in maturing debt by 2025, with $6.5 trillion of that due in June.

Question: What impact do tariffs have on consumer prices?

While tariffs can increase the costs of imported goods, the government anticipates that the long-term benefits, such as job growth, will outweigh the temporary price increases for consumers.