A significant legal confrontation is unfolding as President Donald Trump‘s controversial tariff measures face resistance from New York and eleven other states. The states are challenging the legality of the tariffs imposed under emergency powers, insisting that the actions overstep the authority designated to the federal legislature. The lawsuit, filed in the U.S. Court of International Trade, addresses concerns regarding both economic repercussions and constitutional violations stemming from the President’s unilateral actions.

| Article Subheadings |

|---|

| 1) Overview of the Legal Challenge |

| 2) States’ Arguments Against the Tariffs |

| 3) Implications for the U.S. Economy |

| 4) Support for the Tariffs |

| 5) The Broader Political Context |

Overview of the Legal Challenge

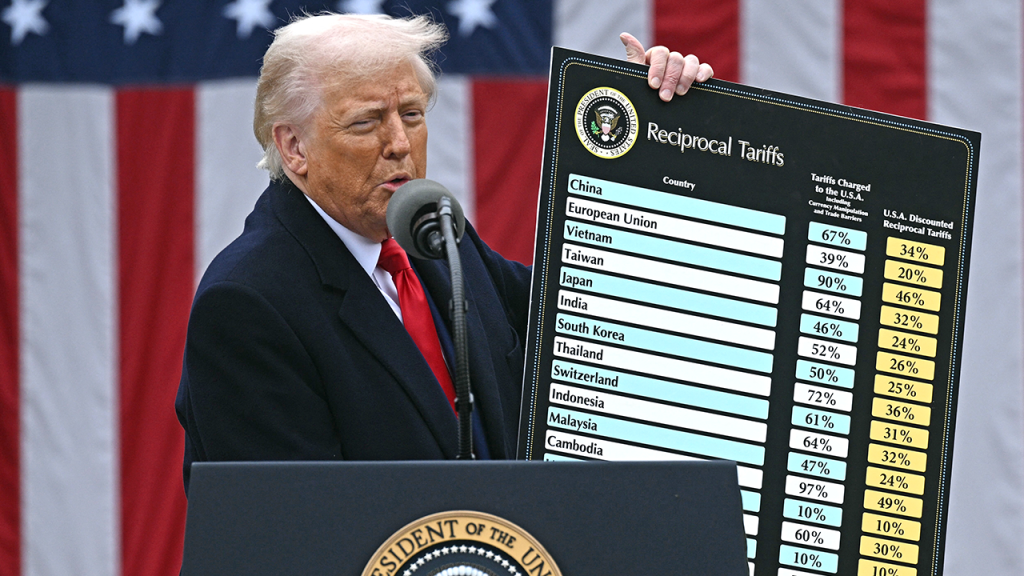

In April 2025, a coalition of twelve states, led by New York, initiated a legal challenge against President Donald Trump‘s sweeping tariffs. This lawsuit critiques his use of the International Emergency Economic Powers Act (IEEPA) as the legal foundation for imposing significant tariffs on imports from various countries. The states argue that such measures exceed the President’s authority as outlined in the constitution, as these powers traditionally reside with Congress, which is empowered to impose taxes and tariffs.

This legal action is unprecedented in its scope, questioning the very authority a sitting president can exert under the auspices of national emergencies. The filing was submitted to the U.S. Court of International Trade, which specializes in matters related to trade law. As the legal battle unfolds, the implications for congressional authority and trade policy could reshape future executive actions.

States’ Arguments Against the Tariffs

The plaintiffs in this lawsuit are emphasizing that Congress, not the President, holds the authority to levy taxes as outlined in Article I of the U.S. Constitution. The states argue that the tariffs were not founded on legitimate emergency conditions, as required by the IEEPA, which permits such actions only under specific international threats, such as terrorism or hostile foreign acts. They contend that these tariffs are instead a broad trade policy tool that no president has employed in the nearly five decades since the law’s passage in 1977.

New York Governor Kathy Hochul and Attorney General Letitia James have characterized the legal challenge as a defense of consumer rights and economic stability. They assert that President Trump’s unilateral imposition of tariffs lacks the legal backing necessary and poses risks of economic turmoil, increased inflation, and job losses. In their view, the tariffs, which impact a wide array of consumer goods, threaten to create widespread financial distress for American families.

Implications for the U.S. Economy

The legal challenge carries significant implications for the U.S. economy and its trade dynamics. Experts warn that the tariffs could lead to a spike in consumer prices, undercutting the purchasing power of American households. The ongoing challenges posed by these tariffs, according to the lawsuit, could ignite inflation and potentially lead to a recession if consumers significantly curtail spending due to rising costs.

Furthermore, the lawsuit claims the tariffs contribute to broad economic instability, jeopardizing businesses that rely on imports for production. The fear is that a sudden rise in costs could lead to layoffs or even business closures, further exacerbating the economic landscape. The stakes are high, as both state officials and economists point out the need for balanced trade policies that do not disproportionately impact consumers and workers alike.

Support for the Tariffs

The Trump administration defends its tariff strategy as a necessary path to rectify long-standing trade imbalances and protect domestic industries. Proponents of the tariffs assert that these measures are part of a broader strategy to strengthen American manufacturing and address issues such as illegal immigration and drug trafficking—issues that were cited as justifications for invoking emergency powers.

During a press conference in February 2025, President Trump claimed, “We took in hundreds of billions of dollars with past tariffs… It’s going to make our country rich.” Supporters argue that the tariffs could stimulate growth in certain sectors and combat unfair trade practices by foreign nations. This perspective underscores a belief that by prioritizing domestic production, the U.S. can achieve greater economic independence and resilience in the global market.

The Broader Political Context

This lawsuit also emerges amidst a volatile political climate, highlighted by ongoing tensions between state officials and federal authority. Governors and attorneys general from states including Maine, Illinois, Arizona, among others, have joined New York’s lawsuit, indicating a growing coalition against what they perceive as overreach by the Trump administration. As these officials clash over tariff implementations, this legal matter encapsulates broader national debates about executive power and the balance of governance.

The dynamics of this case could set precedents for how future presidents utilize emergency powers and engage with state governments regarding economic policy. The outcome will not only affect the current administration but also shape political strategies for future leaders navigating complex trade relationships in a rapidly evolving global economy.

| No. | Key Points |

|---|---|

| 1 | Twelve states, including New York, are challenging President Trump’s tariffs in court. |

| 2 | The lawsuit argues that Congress has the sole authority to impose taxes and tariffs, not the President. |

| 3 | Critics of the tariffs warn about potential negative impacts on inflation and consumer prices. |

| 4 | Supporters of the tariffs argue they are necessary for protecting American industry and addressing trade imbalances. |

| 5 | The legal challenge highlights ongoing political tensions regarding executive authority and trade policy. |

Summary

The legal push against President Trump’s tariffs illuminates a critical conversation about the limits of executive power in the United States and the role of states in challenging federal actions. As the lawsuit progresses, its implications for economic policy and congressional authority will be closely watched by both political analysts and citizens. The unfolding scenario reinforces the complexity of governance in an era marked by rapid economic and political shifts.

Frequently Asked Questions

Question: What are the key legal arguments against the tariffs?

The key legal arguments focus on the assertion that only Congress has the authority to impose taxes and tariffs, as enshrined in the Constitution. The states argue that the President’s use of emergency powers to enact such tariffs is unconstitutional and lacks the necessary legal justification.

Question: How could the tariffs affect American consumers?

The tariffs may lead to increased prices for consumer goods as import costs rise, thereby affecting the purchasing power of families and potentially contributing to overall inflation and economic stagnation. The lawsuit points to concerns that these tariffs may lead to job losses and financial instability.

Question: What is the position of the Trump administration?

The Trump administration defends the tariffs as essential for protecting American industries and correcting trade imbalances. Officials argue that these measures are necessary to bolster national security interests, citing issues such as illegal immigration and drug trafficking as motivating factors.