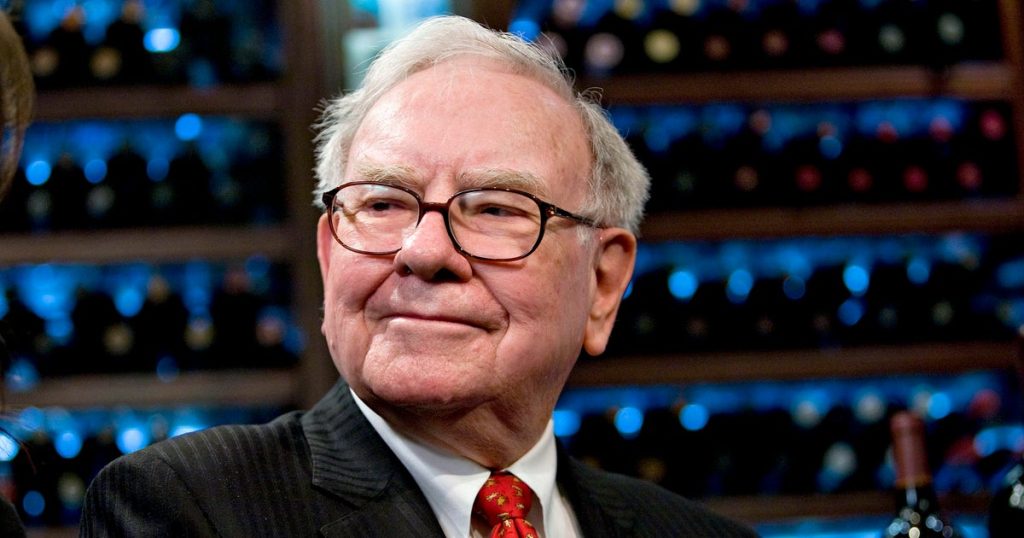

Investor Warren Buffett recently announced a significant charitable gesture, donating $6 billion in stock from his company, Berkshire Hathaway, to five philanthropic foundations. This latest donation brings his total contributions to approximately $60 billion since 2006, reflecting his long-standing commitment to philanthropy. The stock donation consists of nearly 12.4 million Class B shares, valued at $485.68 each as of the most recent market close, marking a continuing pattern of financial support aimed at addressing wealth inequality.

| Article Subheadings |

|---|

| 1) Overview of the Donation |

| 2) Breakdown of Beneficiary Foundations |

| 3) Warren Buffett’s Philanthropic Philosophy |

| 4) Berkshire Hathaway’s Financial Performance |

| 5) The Future of Berkshire Hathaway |

Overview of the Donation

The recent announcement by Warren Buffett regarding his $6 billion donation has captured considerable media attention. This significant act of generosity comes ahead of a planned change in leadership at Berkshire Hathaway. The shares being donated are Class B stocks, noted for their lower entry price compared to Class A shares. Each Class B share was valued at $485.68 as of the last trading day. This contribution, representing nearly 12.4 million shares, reinforces Buffett’s long-standing commitment to philanthropy, further showcasing his belief in redistributing wealth for social good.

Breakdown of Beneficiary Foundations

Buffett’s latest donation is directed towards five foundations, with the largest allocation going to the Bill & Melinda Gates Foundation Trust, set to receive approximately 9.4 million shares. This sizable donation underscores the enduring relationship between Buffett and the Gates Foundation, known for its extensive philanthropic initiatives aimed at healthcare, education, and poverty alleviation. Additionally, the Susan Thompson Buffett Foundation will receive 943,384 shares. Other beneficiaries include the Sherwood Foundation, Howard G. Buffett Foundation, and NoVo Foundation, each slated to receive 660,366 shares. These allocations reflect Buffett’s strategic thinking in philanthropy, hoping to empower organizations that align with his vision for societal improvement.

Warren Buffett’s Philanthropic Philosophy

Warren Buffett is renowned not only for his investing prowess but also for his strong philosophical stance on wealth and philanthropy. Since publicly pledging in 2006 to give away much of his fortune, he has been vocal about his belief in using wealth to combat inequalities within society. The billionaire investor has emphasized that his children will play a vital role as executors of his estate, continuing his legacy of philanthropy. In a recent statement, he articulated his view on wealth, reinforcing that over 99% of his estate is intended for charitable purposes, reflecting a commitment to philanthropic endeavors.

Berkshire Hathaway’s Financial Performance

Berkshire Hathaway has demonstrated robust financial growth, with Class B stock appreciating 19.1% over the last year, outperforming the broader U.S. stock market return of 14.1%. This performance highlights Buffett’s renowned investment strategy that focuses on purchasing undervalued companies and managing investments conservatively. With a net worth estimated around $145 billion, largely tied to Berkshire’s stock, Buffett’s investment decisions have consistently proven effective in building substantial wealth. He attributes this growth to sound business decisions, the favorable American economic climate, and the effects of compounding growth.

The Future of Berkshire Hathaway

As Buffett prepares for a transition in leadership, he has expressed intentions to recommend Greg Abel as his successor as CEO by the end of the year. This move marks a pivotal moment in Berkshire Hathaway’s governance, ensuring continuity and stability within the organization. Buffett, who has indicated that he will not be selling any shares himself, believes in maintaining the integrity of the company while implementing his philanthropic commitments. The company’s proven track record and strategic vision under Abel will be closely monitored by investors and the public alike as Berkshire ventures further into the future.

| No. | Key Points |

|---|---|

| 1 | Warren Buffett donated $6 billion worth of Berkshire Hathaway stock to five foundations. |

| 2 | The donation includes nearly 12.4 million Class B shares, valued collectively at $6 billion. |

| 3 | Major beneficiaries include the Bill & Melinda Gates Foundation Trust and the Susan Thompson Buffett Foundation. |

| 4 | Buffett has pledged to give away the majority of his wealth, focusing on philanthropy aimed at reducing wealth inequality. |

| 5 | Berkshire Hathaway’s financial performance has been strong, with stock prices increasing by 19.1% over the past year. |

Summary

Warren Buffett’s recent donation of $6 billion in Berkshire Hathaway stock stands as a testament to his enduring commitment to philanthropy and wealth redistribution. This action not only benefits five prominent foundations but also reinforces Buffett’s legacy as an advocate for addressing societal inequalities through charitable endeavors. As he transitions leadership within Berkshire Hathaway, his continued focus on philanthropy reflects a broader trend among wealthy individuals leveraging their resources for social good.

Frequently Asked Questions

Question: How does Buffett’s donation affect Berkshire Hathaway?

Buffett’s donation is a significant charitable move that does not affect the overall operations of Berkshire Hathaway, but it signals his commitment to philanthropy and provides substantial support to the chosen foundations.

Question: Who will manage the funds from the trusts receiving Buffett’s shares?

The foundations receiving the shares, such as the Bill & Melinda Gates Foundation, are managed by their respective boards and executors, who will allocate the funds according to their philanthropic missions.

Question: What are the implications of Buffett’s succession plan for Berkshire Hathaway?

Buffett’s recommendation of Greg Abel as his successor indicates a strategic plan for maintaining stability and continued growth at Berkshire Hathaway, reflecting a seamless transition that investors anticipate will uphold the company’s success.