As tensions rise around the global supply of crucial minerals, particularly rare earth elements (REEs), the West is increasingly focused on reducing its reliance on China. Recent reports highlight the strategic moves being made by various stakeholders, including the U.S. Department of Defense and companies like Toyota, to diversify their sources and recycle existing materials. These efforts stem from concerns over China’s dominance in the REEs market, where it controls a significant percentage of production and reserves. Analysts emphasize the complexities and challenges associated with shifting away from dependence on Chinese supplies.

| Article Subheadings |

|---|

| 1) The Growing Importance of Rare Earth Elements |

| 2) West’s Response: Investing in Alternatives |

| 3) China’s Export Controls and Their Impact |

| 4) Recycling and the Future of EVs |

| 5) Broader Implications for Global Trade |

The Growing Importance of Rare Earth Elements

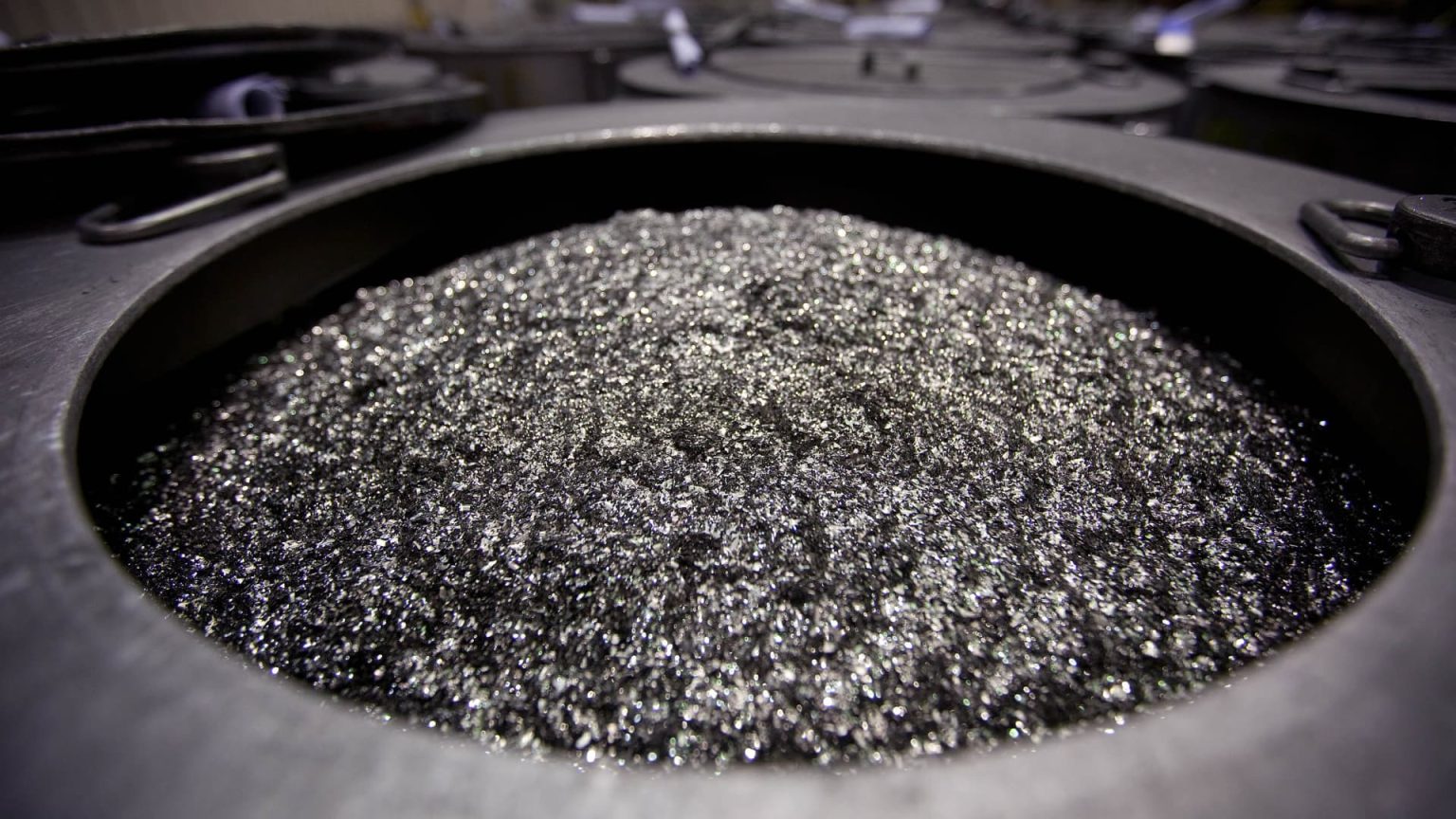

Rare Earth Elements are increasingly recognized for their critical role in the manufacture of modern technology, especially in electric vehicles (EVs) and other advanced equipment. As noted by consulting firm AlixPartners, modern vehicles utilize significant quantities of REEs, underscoring their importance to the automobile industry. In 2024, China controlled approximately 69% of the supply of these essential minerals, along with nearly half of the world’s reserves. This monopoly raises alarms among Western policymakers, who are concerned about over-dependence on a single country for such vital components.

China’s dominance has accelerated due to its investments in mining, refining, and manufacturing technologies necessary for producing high-performance magnets and batteries. Among the most noteworthy applications of REEs is in EVs, where they play a crucial role in motor efficiency and energy storage. Specifically, a typical battery electric vehicle is estimated to contain around 550 grams of REEs, in contrast to approximately 140 grams in traditional gasoline-powered vehicles. This significant difference highlights the growing utilization of these materials in the automotive sector.

West’s Response: Investing in Alternatives

In response to the rising dependence on Chinese-restricted supplies, Western entities are actively seeking alternative sources and methods to secure a consistent supply of REEs. For instance, the U.S. Department of Defense recently allocated $4.2 million to Rare Earth Salts, a startup focused on extracting REEs from recycled fluorescent light bulbs. Such initiatives are key to enhancing domestic capabilities within the U.S. and reducing reliance on Chinese imports.

Furthermore, companies such as Toyota are investing in research and technology aimed at minimizing the required amount of REEs in their products. This proactive approach aims not only to secure supply chains but also to lessen the environmental impact associated with mining and refining these materials.

With many industry analysts suggesting that existing REE stocks can be recycled, the push for innovations in recycling technology is gaining momentum. As stated by Christopher Ecclestone, a principal analyst in the mining sector, “Pretty soon, the first generation of EVs will be up for recycling themselves, creating a pool of ex-China material that will be under the control of the West.” With EV adoption on the rise, opportunities for recycling are likely to expand significantly in the coming years.

China’s Export Controls and Their Impact

In April 2024, China implemented new export controls on essential rare earth components, including terbium and cerium, critical for the manufacture of EVs. These restrictions necessitate governmental approval for firms handling these materials to sell overseas. Such measures have intensified concerns over supply chain stability for countries reliant on Chinese materials.

According to various analyses, China’s stringent export policies could lead to inflated prices and supply shortages in Western markets, which are already grappling with increased competition for REEs. These developments highlight the urgent need for Western businesses to seek out diversified supply sources and direct investments into alternative mining operations.

As China’s dominance continues, the International Energy Agency points out that the country controls over 90% of the global refined supply for the four magnet rare earth elements: neodymium, praseodymium, dysprosium, and terbium. Without diversified sources, Western manufacturers may face prolonged disturbances in access to these crucial materials.

Recycling and the Future of EVs

Recycling capabilities for rare earth materials remain challenging due to their energy-intensive and time-consuming processes. However, as adoption of EVs continues, the trend towards recycling certain components is becoming increasingly vital. For example, the potential for salvaging rare earth elements from battery packs is a topic of research and investment.

Industry experts suggest that the growing inventory of older EVs will eventually lead to a substantial supply of materials that can be reused. According to estimates, approximately 550 grams of REEs per vehicle could potentially be recovered as early as 2030, contributing to a new influx of materials available for manufacturing.

The recycling of materials not only helps alleviate dependence on foreign imports but serves to reduce environmental footprints associated with mining. The recycling industry also provides economic opportunities and potential job creation in green technology sectors, adding another dimension to the importance of this development.

Broader Implications for Global Trade

The ongoing struggle over rare earth elements has broader implications for international trade relations and geopolitical dynamics. As countries strive for technological independence, the competition for critical minerals is intensifying. Consequently, many nations are re-evaluating their mining policies in a bid to attract investment and develop their own reserves.

Recent moves by the U.S. to encourage domestic REE production and processing capabilities reflect a growing recognition of the strategic nature of these minerals. Analysts believe that reducing reliance on China’s singular control will require sustained governmental initiatives and collaborations within the private sector.

As noted by personnel at the Royal United Services Institute, establishing new mining operations is a lengthy and complex process that can take several years to begin production. As a result, the West must act decisively and strategically to develop alternative supply routes while preparing for potential supply chain disruptions in the future.

| No. | Key Points |

|---|---|

| 1 | China controls 69% of global rare earth element production and nearly half of the world’s reserves. |

| 2 | U.S. investment in recycling and alternative technology aims to reduce reliance on Chinese rare earths. |

| 3 | New Chinese export controls have increased concerns about supply chain stability in the West. |

| 4 | Recycling of rare earth materials offers a promising avenue for future supply and sustainability. |

| 5 | Global competition for critical minerals impacts international trade and geopolitical relations. |

Summary

The shifting dynamics in the rare earth elements market reflect larger trends in global supply chains and geopolitical tensions. With China’s tight grip on REE production and the West’s urgent need for alternative sources, this situation presents both challenges and opportunities. Ongoing efforts to invest in recycling technologies and develop new suppliers highlight a collective commitment to achieving greater self-sufficiency in critical minerals. As the global landscape evolves, the strategic importance of these materials will likely shape the future of industries ranging from automotive to defense.

Frequently Asked Questions

Question: What are rare earth elements?

Rare earth elements are a group of 17 metallic elements that are integral to the functioning of modern technology, including electronics, batteries, and magnets.

Question: Why is the U.S. focused on recycling rare earth materials?

The U.S. is focusing on recycling to reduce reliance on imports, enhance supply chain resilience, and minimize the environmental impact associated with mining new materials.

Question: How does China’s export control affect global trade?

China’s export controls on rare earths have significant implications for global markets, potentially leading to increased prices and supply shortages for countries dependent on these materials.